Hot 100

Jump to winners | Jump to methodology | View PDF

INSURANCE’S BEST AND BRIGHTEST

After surviving a tumultuous 2020, the US insurance industry has enjoyed slightly calmer seas in 2021. Still, uncertainty abounds, and in an always competitive landscape, fortune rewards the bold. From rising stars who are helping transform the industry with innovative solutions to seasoned veterans who are helping steer large organizations through turbulent times, the 100 professionals who made IBA’s annual Hot 100 list for 2022 have no shortage of boldness.

While their industry experience may vary, all of this year’s Hot 100 honorees have at least three things in common: a can-do attitude in the face of adversity, a solid understanding of themselves and the industry, and a willingness to extend a helping hand to the next generation of insurance professionals.

Rising to the challenge

For Hot 100 winner Tony McIntosh, a managing partner at The Liberty Company Insurance Brokers and president of Liberty's MGA facility, Aura Risk Management & Insurance Services, resilience has been key to building his career. Ten years ago, he made the leap from a family-owned MGA into a marketing role on the retail side of the industry with Barney & Barney (now Marsh McLennan Agency). McIntosh says he initially struggled in his new role, where he was responsible for helping producers and service teams negotiate coverage and position clients with carrier partners. However, he trusted in his mentor and boss and realized how important it was to learn new things each day.

“I leveraged this time and previous entrepreneurial, sales, and leadership experience into founding a property & casualty division at a publicly traded bank and then acquiring that business under private ownership years later,” he says. “That brief difficult period of transition provided the opportunity for me to advance my career further and gain new partnerships and opportunities in this beautiful insurance business. All of this has led me to where I am today, of which I could not be happier.”

Fellow Hot 100 honoree Eden Hancock, an area senior vice president for Risk Placement Services (RPS), faced similar challenges when deciding to change employers earlier in her career.

“I honestly did not understand the roller coaster of a journey I was about to embark on when I made the switch,” she says. “When a decision is great, it will inevitably create some controversy, and oftentimes there can be sore points. To have peace, you must stay true to yourself. Avoid the distraction others may create – rise to the occasion and challenge yourself to show your worth and value. You, as I did, will come out better, stronger and happier.”

Hancock’s book of business is now 50% larger than it was when she started at RPS three years ago. What’s more, she’s led her fleet/transportation department to 50% year-over-year growth to become the fastest-growing segment in her branch.

Hancock says she has a few attributes that set her apart from the competition. The first is her ability to “read the room”; she acknowledges that there can’t be a one-size-fits-all approach to personal interactions. She also has a knack for working diligently and not making a lot of noise, and she believes it’s important to dress up and show up to the office – a real office – each day.

For RPS’ Adam Wood, who began his career as a tennis pro before moving into insurance in 2014, success has been the result of taking accountability.

“Early in my career, we lost out to a market that we had access to,” Wood says. “This is hard news to give an agent, but I am a firm believer in holding your hand up and not making excuses. [The agent and I] had a candid conversation about what happened and cleared the air. We still work with each other today, and he passed my contact along to his colleagues. Today, those referrals are my largest clients.”

Wood says he differentiates himself from his peers through his ability to establish trust and facilitate business processes, helping agents to sell and exhibiting due diligence and quote options for the insured. In 2021, he achieved 100% growth of his book of business and was promoted to assistant vice president and Southeast casualty manager at RPS. For the past two years, he’s written more than $400,000 in new business each year and landed an exclusive trucking program with Crum & Forster.

Nurturing new talent

They’ve built their own stellar careers by persevering through difficult times – so what do the members of this year’s Hot 100 list think insurance companies can do to better cultivate talent?

“Be mindful of creating joy in your staff – success sparks joy, and joy fuels further success,” McIntosh says. “If everyone is doing something they love to do and it brings joy throughout their day, you will inevitably see better results from your team. Wellness is vital to incorporate into your business philosophy and culture.

Be completely transparent with your teams on strategy objectives, goals and opportunities.”

Hancock, meanwhile, says she’s “a true believer that people want to grow. They want to be a part of something bigger. Create a team that wants to ‘put a man on the moon while mopping floors.’ Promote from within, listen to your employees’ ideas and advocate for those employees. Be flexible and movable.”

Wood believes insurance companies can and should do more to train their producers. “Insurance hires great talent and often fails to teach them the ropes,” he says. “The sink-or-swim mentality for new hires is not what young people today are looking for, in my opinion. I personally take great pride in developing talent within RPS.”

For those just starting out in insurance, McIntosh’s advice is to “push yourself to the edge. Find out what stretches you and what you want to work on to improve in business and life. Find a good work-life balance that allows you to stay healthy. A good way to think about it throughout the year is what figurative leaves can you shed this season to allow you to clear the path towards your objectives? Try and focus on one thing at a time to accomplish more throughout your day. The insurance business moves very quickly. [Staying] on top of current events and how those may implicate carriers’ results and their eventual pivots with rates/limits/capacity adjustments, along with your clients’ buying decisions, is crucial to becoming remarkable.

“The other thing I would strongly encourage is to build a personal community of interest [COI] network that can help tell your story to others within your focused business segments. I can’t stress the power of this effort and the results that come with it. The insurance business is a long play, not a get-rich-quick career.

The more investment you put into yourself, your COI network and your clients, the greater the return will be for you and your family.”

Along those same lines, Hancock’s advice for those just starting out is to be there when no one else is. “Soak in every bit of it as it comes,” she says. “My definition of ‘it’ is everything. Take advantage of every opportunity to take notes, to listen in, to get the drinks, to share an Uber, to pick a brain, to ask the question you are afraid to ask. Put yourself out there, and people will notice. Finally, be the person your clients trust.”

Wood echoes the advice he received from an old tennis coach. “Be default aggressive,” he says. “If things don’t go your way, be aggressive with marketing efforts. If you lose a renewal, aggressively make more cold calls. When I am on the offense, it helps my mood and focuses my mind on the positives.”

Hot 100

- Alex Bovicelli

Tokio Marine HCC - Amir Farid

Westfield - Amy Stepnowski

The Hartford/Hartford Investment Management Company - Andy MacFarlane

AXA XL - Angela Noble

EMC Insurance Companies - Anthony J. (Tony) Kuczinski

Munich Re US Holding - Anton Rosandic

ALKEME - Barbara Ingraham

Verisk - Belen Tokarski

Mylo - Beth Carter-Drury

Eagan Insurance Agency - Billy Grossmiller

AssuredPartners - Bob Hitchcock

Brightway Insurance - Brian Schneider

Higginbotham - Candace Rhea

The Hartford - Carrie O’Neil

CAC Specialty - Chaya Cooperberg

AmTrust Financial - Chetan Kandhari

Nationwide - Chris Zoidis

H.W. Kaufman Group - Christiaan Durdaller

INSUREtrust - Christine Rogers

Robertson Ryan & Associates - Dr. Claire Muselman

North American Risk Services - Clinton Anderson

HUB International - Curtis Barton

ALKEME - Cyndi Doragh

Iron Ridge Insurance Services - Dameion Baker

CAC Specialty - Daniel Ginden

Scottish American Insurance - David Boren

Synapse Services - David Lewison

Amwins - Davis Moore

Amwins - Debbie Brackeen

CSAA Insurance Group - Denise Lloyd

D.H. Lloyd & Associates - Denise Perlman

Marsh McLennan Agency - Elizabeth Davies

Stonemark - G. Greg Gunn

Gunn-Mowery - Garrett Droege

IMA Financial - George (Chip) Atkins

RH Clarkson Insurance Group - George Rusu

Captive Resources - Grace Grant

Gamma Iota Sigma - Jeff Kroeger

Insureon - Jeffrey T. Benson Jr.

Prominent Insurance Agency - Jeffrey T. Benson Jr.

Prominent Insurance Agency - Jessica Kearney

Travelers - John Lupica

Chubb - Jonathan Charak

Zurich North America - Jose Suarez

Assurance, a Marsh McLennan Agency company - Justin Goodman

AssuredPartners - Justin Kesner

Amity Insurance, a division of Brown & Brown of Massachusetts - Karl Henley

SeibertKeck Insurance Partners - Kelly Augspurger

Steadfast Insurance - Kerri Roberts

TIG Advisors - Kevin Gazitua

JAG Insurance Group - Krishna Lynch

Zurich North America - Lael Chappell

Attune - Laurna Castillo

CSAA Insurance Group - Leslie Wright

Brightway Insurance - Linda Merenguelli

HUB International Northeast - Mark Walls

Safety National - Marty Sansone

The Zebra - Matthew Cooper

Inner-City Underwriting Agency - Meredith Frick

Marsh McLennan - Michael Sicard

USI Insurance Services - Miles Wuller

RSG Underwriting Managers - Misty Kuckelman

Travelers - Montrae Williams

The Hartford - Nick Kohal

American Risk Management Resources Brokerage - Patrick G. Ryan

Founder, Chairman and CEO Ryan Specialty Group - Paul Gaglioti III

Harbor.ai - Paul Roberts

Word & Brown General Agency - Peter R. Taffae

Executive Perils - Rebekah Ratliff

JAMS - Robert Wiest

MS Amlin - Sara Kane

CAC Specialty - Scott Purviance

Amwins - Shannell Chibueze

Woodruff Sawyer - Sonji Grandy

Alliant Insurance Services - Sydney Hedberg

Marsh McLennan - Ted Dimitry

Higginbotham - Thomas Orabona

Synapse Services - Thomas Schaedel

RT Specialty - Tony McIntosh

The Liberty Company Insurance Brokers - Travis Pearson

CMR Risk & Insurance Services - Xiaolin Gong

Coalition - Yafit Cohn

Travelers - Yelena Dunaevsky

Woodruff Sawyer - Zak Fanberg

Eagan Insurance Agency

Methodology

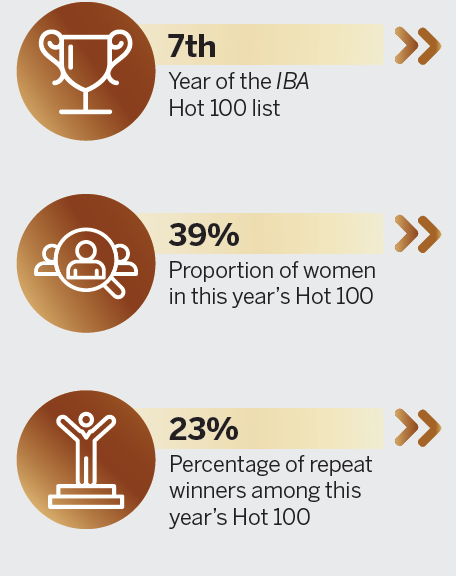

Starting in August, Insurance Business America invited insurance professionals from across the country to nominate their most exceptional leaders for the seventh annual Hot 100 list. After receiving hundreds of nominations, IBA narrowed the list down to 100 movers and shakers whose contributions have helped shape the insurance industry over the past 12 months.

From innovators at the forefront of change to leaders who are transforming the way the industry does business, this year’s Hot 100 list represents the best the industry has to offer.

Keep up with the latest news and events

Join our mailing list, it’s free!