Cyber insurance has become a popular risk management tool among businesses across the country, especially with the rapid shift to digital transformation giving rise to constantly evolving cyber threats. And as the frequency and severity of these cyberattacks intensify, the top cyber insurance companies in the US have a vital role to play in keeping businesses protected.

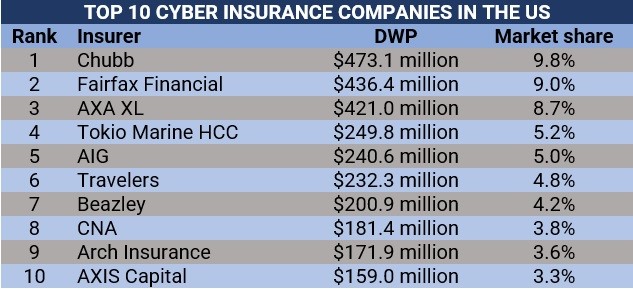

The nation boasts a thriving cyber insurance sector that is predicted to become a $20-billion industry by the middle of the decade, with the 10 largest cyber insurers accounting for almost 60% of the overall market. These insurers offer a range of policies designed to protect businesses in varying industries.

To give you an overview of the different levels of coverage available, Insurance Business lists the top cyber insurance companies in the US in this article. If you’re looking for a cyber insurance provider that can cater to the unique coverage needs of your business, this piece can give you reliable options.

Direct written premiums: $473.1 million

Market share: 9.8%

Swiss industry giant Chubb is not only the top cyber insurer in the US, it is also among the largest insurance companies in the world. Its country headquarters is in Whitehouse Station, New Jersey.

Chubb offers three products under its cyber insurance portfolio. These are:

Direct written premiums: $436.4 million

Market share: 9.0%

Toronto-based financial holding firm Fairfax Financial offers a range of property and casualty insurance and reinsurance products, as well as investment and insurance claims management services. The industry behemoth offers cyber insurance policies to US businesses through its several subsidiaries, including:

Direct written premiums: $421 million

Market share: 8.7%

AXA XL is the US-based subsidiary of the French insurance giant AXA. It holds headquarters in Stamford, Connecticut.

AXA XL’s flagship cyber insurance policy, called CyberRiskConnect, provides tailored cyber protection for businesses in different industries. Coverage includes:

Policyholders can also access a range of risk mitigation services from AXA XL partners, including:

CyberRiskConnect provides up to $15 million in coverage available on a primary or excess basis.

AXA XL also holds partnerships with Microsoft and Slice Labs in an initiative aimed at helping protect users of Microsoft’s digital tools.

If only there was a cheat sheet that would help you prepare, prevent, and recover from a #cybersecurity attack…well there is, and we’ve got it. Check out AXA XL’s Cyber Claims Road Map: https://t.co/2z9rhk48t4 #CyberSecurityAwarenessMonth #cyberattack pic.twitter.com/Q9KakNmQKy

— AXA XL (@AXA_XL) October 13, 2021

Direct written premiums: $249.8 million

Market share: 5.2%

Japanese industry giant Tokio Marine Group offers specialty insurance policies in the US, the UK, Spain, and Ireland through its subsidiary Tokio Marine HCC. Its US-based insurance arm holds its headquarters in Houston, Texas.

Tokio Marine HCC’s Cyber Security Insurance policy provides first-party and liability protection for up to $25 million on a primary and excess basis. Coverage includes cybercrime prevention, crisis response, and post-incident expertise.

Tokio Marine HCC's Cyber & Professional Lines Group (CPLG) takes a hands-on and tech-driven approach to underwriting. Its success has landed it on Insurance Business America’s list of 5-Star Cyber Insurers.

Direct written premiums: $240.6 million

Market share: 5.0%

Among the top cyber insurance companies in the US, AIG is also one of the first insurers in the country to launch a cyber insurance program – that was more than 20 years ago. To date, the New York-based insurer has over 30,000 policyholders under its flagship cyber coverage, CyberEdge and handles at least five cyber claims daily.

CyberEdge provides up to $100 million in coverage and has no minimum retention. It pays out for the costs associated with a data breach, including:

CyberEdge can be purchased as a standalone product or added to AIG’s select financial lines, and property and casualty insurance policies.

Direct written premiums: $232.3 million

Market share: 4.8%

Travelers offers tailored cyber liability protection for businesses with varying levels of risk. Coverage includes:

The New York-based property and casualty insurer’s cyber insurance lineup consists of four policies. These are:

Direct written premiums: $200.9 million

Market share: 4.2%

Beazley offers four types of products under its cyber and technology portfolio designed to provide businesses with financial protection in the event of a cyberattack. These are:

The London-based insurer provides cyber insurance to US businesses through its several branches across the country. Its American headquarters is located in San Francisco, California.

Direct written premiums: $181.4 million

Market share: 3.8%

Based in Chicago, CNA is one of the largest commercial P&C insurers in the US and also among the country’s top cyber insurance companies. Its cyber insurance policies offer the following coverages:

Cyber insurance clients can also choose from four types of plans. These are:

Without cyber insurance, the costs associated with a breach could very well put a company out of business. CNA's Brian Robb discusses with @GARP_Risk why cyber insurance is a critical part of risk management: https://t.co/PSeh1KUTKu pic.twitter.com/5NJuZV4yPN

— CNA Insurance (@CNA_Insurance) November 7, 2019

Direct written premiums: $171.9 million

Market share: 3.6%

Arch Insurance’s cyber coverage has a limit of up to $20 million for any one risk. Among the industries the policy caters to are:

Its flagship cyber insurance policy, called Arch Netsafe 2.0, includes the following features and benefits:

Direct written premiums: $159 million

Market share: 3.3%

AXIS Capital offers cyber insurance designed for large and middle-market businesses. It has up to $25 million liability limits and covers business interruption losses, including those from dependent businesses and reputational harm. The policy also covers expenses and penalties resulting from regulatory and PCI-DSS non-compliance.

Recently, the insurer also rolled out its AXIS Cyber Technology and Miscellaneous Professional Liability (ACTM) policy aimed at helping businesses avoid potential protection gaps by allowing them to combine multiple coverages in one policy. ACTM is designed for companies with up to $2 billion in revenue and can be purchased through brokers on both an admitted and non-admitted basis.

AXIS Capital is based in Pembroke Parish, Bermuda and has 28 offices globally. In the US, the insurer has branches in Los Angeles, Chicago, Kansas City, New York, Hartford, and Franklin Lakes

We based our findings on determining the 10 leading cyber insurers in the country based on the National Association of Insurance Commissioner’s (NAIC) latest market share data.

Here’s a summary of the top cyber insurance companies in the US based on direct written premiums and market share:

Cyber insurance is a type of insurance policy designed to cover financial losses stemming from cyber incidents. Generally, this form of coverage offers two types of protection, namely:

This policy pays out for the financial losses a business incurs because of a cyber incident, including:

Most first-party policies also cover the cost of notifying clients about the cyber incident and providing them with anti-fraud services.

Also referred to as liability coverage, this type of policy provides financial protection against lawsuits filed by third parties – such as customers, employees, and vendors – for damages caused by a cyberattack on their businesses. It typically covers court and settlement fees, as well as regulatory expenses and fines.

Cyber insurance premiums on average start at $500 annually for basic coverage and can exceed $5,000 for comprehensive protection. Nationally, several industry and personal finance websites peg the cost at about $1,600 each year for $1 million worth of cover.

The amount of coverage your business needs, however, can be significantly higher or lower depending on a range of factors. Here are some of the metrics you need to consider to work out how much cyber insurance coverage your business requires:

Premiums, however, are calculated differently depending on the type of policy. If you want to understand how this insurance component works, you can check out our comprehensive guide on insurance premiums.

Industry experts warn businesses that cyber criminals do not discriminate based on a company’s size. And with the rapid pace of digital transformation giving rise to new and potentially more damaging cyber risks, it pays to get some form of cyber protection. More so if your company manages sensitive customer or employee data, has a large client base, and owns valuable digital assets.

These experts also remind businesses that they cannot rely solely on cyber insurance to bail them out when they fall victim to a cyberattack. To remain insurable, your business needs to do its part and take robust precautions against cyber threats.

If you own a small business and are trying to come up with cost-effective ways to prevent a cyberattack, you can find some practical tips in our cybersecurity guide for small businesses.

An experienced insurance agent or broker can guide you in your search for the cyber coverage that best fits your needs. To find reliable and trustworthy insurance professionals, we recommend that you check out our Best in Insurance America page.

In this page, we feature only insurance companies that are nominated by their peers and vetted by our team of experts as dependable industry leaders. By dealing with these providers, you can have peace of mind in knowing that you are getting the best coverage from someone you can rely on during challenging times.

For ongoing coverage of the cyber insurance world, be sure to visit our cyber insurance newspage for the latest information.

Have you experienced working with the top cyber insurance companies on our list? Do you think they offer the best coverage? Send us your thoughts in the comment section below.